Simplifying Savings: A UX Strategy for Making Investing Easy

By implementing user-friendly design principles, we can transform the savings experience, making it more engaging and less intimidating for the average person:

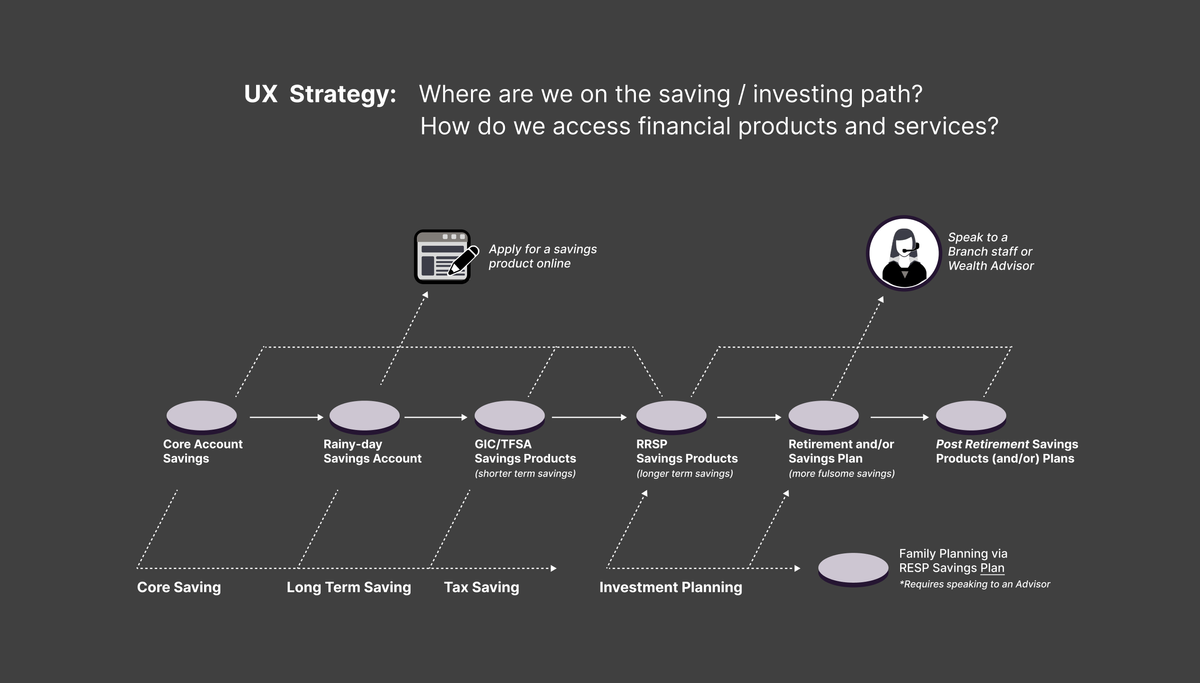

At Humanjava Enterprises, we are dedicated to the belief that investing should be accessible and straightforward for everyone. By leveraging strategic UX design, we can demystify the complexities of financial planning and empower individuals to take control of their financial futures with confidence. The graphic (above) illustrates the savings spectrum, from basic accounts to advanced investment plans; showing how thoughtful design can guide users seamlessly through their financial journey.

The strategic goal is to help those who are ready to move up the savings ladder. Creating web-pages, and online tools, containing prompts and qualifiers to help people self-identify their-own readiness to move forward on their savings journey.

Simplifying the Savings Journey

In general, the journey of saving and investing often feels daunting, but it doesn't have to be. Following the path of no-savings to long term investing through user-centered strategy, this process intuitive and approachable.

It all starts with defining the stages and steps:

- Core Account Savings: Starting with basic savings accounts, it's crucial to create interfaces that are easy to navigate and understand, laying a solid foundation for users beginning their savings journey.

- Rainy-Day Account Savings: These accounts should offer clear benefits and easy setup processes, ensuring users can quickly create financial safety nets for unexpected expenses.

- GIC/TFSA Savings Products: Shorter-term savings products like GICs and TFSAs need straightforward explanations and transparent interest calculations to help users make informed decisions.

- RRSP Savings Products: Long-term savings plans, such as RRSPs, benefit from educational content and planning tools that demystify tax advantages and retirement benefits.

- Retirement and/or Savings Plan: Comprehensive retirement plans should offer personalized projections and scenario planning to help users visualize their financial future.

- Post-Retirement Savings Products: These products need to focus on simplicity and accessibility, ensuring users can easily manage their finances during retirement.

- RESP Savings Plans: Education savings plans require clear guidance and advisor access, highlighting their benefits and simplifying the process of saving for future educational expenses.

UX Strategies for Accessible Investing

By implementing user-friendly design principles, we can transform the savings experience, making it more engaging and less intimidating for the average person:

1. Clear, Guided Navigation

Simplified navigation and clear call-to-actions are essential. For example, our needs-based call-to-actions guide users through their financial journey, from opening a basic savings account to planning for retirement, reducing cognitive load and enhancing user confidence.

2. Empathetic Design and User Insights

Conducting empathetic interviews helps us understand user needs and challenges. This understanding allows us to design interfaces that are both emotionally and functionally resonant.

3. Iterative Prototyping and Testing

Rapid prototyping and usability testing allow us to continuously improve designs based on real user feedback. This iterative approach ensures the final product meets user expectations and provides a seamless experience.

4. Personalized Financial Guidance

Integrating features that offer personalized financial advice can simplify complex decisions. By providing tailored recommendations, users can feel more confident and informed about their savings and investment choices.

Conclusion

Investing doesn't have to be hard. Through empathetic design, clear navigation, and personalized advice, we can simplify the financial journey, making it accessible and approachable for everyone. At Humanjava Enterprises, we are committed to partnering with our clients to bring these strategies to life, ensuring the end-users feel supported and confident as they navigate their financial futures.

Partnering with Vergel Evans for UX Excellence

With over 20 years of experience in UX research, design thinking, and project management, Vergel brings a wealth of knowledge to any financial project. His work with major clients like Aviso Wealth and CIBC highlights Vergels' ability to lead cross-functional teams and implement design thinking principles that enhance user experiences.